| mean | $73,829 |

| median | $77,238 |

| mode | $77,238 |

| standard deviation | $77,238 |

| min | $1 |

| max | $260,004 |

- Estimated (mean) per capita income in 2009: $27,138

- Estimated median household income in 2009: $45,734 (it was $38,625 in 2000)

| mean | $73,829 |

| median | $77,238 |

| mode | $77,238 |

| standard deviation | $77,238 |

| min | $1 |

| max | $260,004 |

Focused on hitting their milestones and/or quotas, investor-fueled and publicly-traded ventures alike will be putting on the hard-sell this trade show season. Panel and exhibit hall attendees certainly know the drill. Prospects will be dazzled, plans hatched and hopes dashed with the latest BSO (bright shiny object) hanging in the balance. On tap across booth chit-chat, panel pontification, martinis and outdoor activities will be information (not to mention outright disinformation). Perpetual conversion machines are the latest rage!

After years of consolidation and financial speed bumps the current industry, while seeing more revenue has definitely shrunk in terms of choices. It should not be a surprise that many battle-scarred survivors have benefitted from this and effective technology lock-in strategies. The result for some technology buyers has been worse service levels and slowed innovation. Nonetheless, gaps in the incumbent’s vision or their inability to consistently innovate have spawned mini-me’s up and down the stack; some trying to create their own lock-in. Unfortunately, all this has all been accepted as a cost of doing business.

To buyers of stack technologies: caveat emptor.

We Know What You’re Up To

Once the technology deal is done – it is going to be too late. Control immediately begins to shift from the technology buyer to the seller. Why does leverage shift? In economic terms, the buyer may have just unwittingly entered into a deal with a micro-monopolist. While this could be arguably true for many industries, for stack buyers this has more severe consequences. The kind that are often obfuscated yet pervasive and only become fully understood in time. It goes way beyond simple buyer’s remorse.

Ad Technology Stack business models that rely on technology lock-in do so because their investors and management have found that such switching inflexibility works for them. One need only look around to find many mainfestations across the stack, mainly in two areas:

Due to information asyncronicity, technology buyers often don’t realize fast enough that they are really signing up to purchase a series of products and services -all when they are at the greatest informational disadvantage. As a result, stack buyers can easily become captives of their own making. A little diligence and research upfront can mitigate the common self-inflicted damage caused by lock-in.

Switching Cost and Lock-in

In game theory, a product or service has a switching cost when the buyer purchases it over multiple periods of time and experiences time, cash or opportunity costs to switch from one seller to another. Switching costs can also occur when a buyer purchases additional complementary products or services making substitutes relatively more expensive; increased complexity is positively correlated with higher switching costs.

Altogether this effectively shifts the supply curve and creates the “lock-in” effect thus raising costs for the buyer. Clearly, switching items in the stack can have unintended negative consequences. More specifically, when a businesses contracts with a stack company there are usually multiple economic components to what is effectively the total cost of ownership (TCO):

All of the above combine to create an effective transaction or cost of switching. Although implementation is an obvious one-time cost (sometimes the largest component), other costs are more subtle and may actually increase over time. Practical scenarios might include:

Staying Balanced in the Melee

While the lock-in strategy has worked well for technology sellers in the past, many Ad Technology Stack ventures are about to get their legs kicked from under them. Enter tag (data) management companies like BrightTag, Tagman, Ensighten and Tealium.These companies are exclusively, if not mostly focused on managing proliferating page tags which are a major culprit behind stack lock-in. Having one technology locked-in that you’ve planned for is probably better than fifteen that just happened over time.

In addition to to making the business of digital marketing actually manageable from a logistical tag and data-sharing standpoint, the larger possibilities are tantalizing for stack buyers wrestling with IT/development queues. Simply put, tag management changes the balance of leverage away from the sellers towards their customers. Analytics expert, Eric Peterson called this out in a recent white paper saying:

“…as implementations become more involved and sophisticated the businesses willingness to switch vendors declines, even in situations where the relationship has been badly damaged by miss-set expectations, miscommunication, or outright lies”

Fear and Loathing

Yes, positive change is in the air for the industry. Widespread use of tag management systems make this an inevitability. However, reactions span the contninuum:

No wonder that the reactions from the ad technology stack about universal tag management have been mixed – these tag management companies are upsetting the status quo and threatening lock-in!

Laggards are doing what they do: delaying and holding out. They are not happy about this. Some are attempting to make tying deals to lock-in even more. For this desperate and unimaginative bunch, it will be a slow and steady burn as the balance of power swings back; some may even get crushed. Others will respond by acquiring companies or being acquired. Still others will hit the wall or just become irrelevant.

More proactive technology sellers see this as an opportunity for competitive advantage and customer relationship-building. This breed of stack company is already knows how to adapt to the new reality of constantly being tested. They are fast failers and built to optimize, now using the opportunity to proactively to gain compeititve advantage.

Moving Forward

Technology stack buyers must balance the fear of being left-behind with a more reasoned approach. Sellers must be able to provide value today without depending on technology lock-in to be successful in the long-term; management discipline and technology agility are essential.

On the upside, one promising trend is that for the first time since the implosion of the Web 1.0 industry, business development (not strategic sales execs) executives are popping up across Ad Technology Stack start-ups. Having the organizational competency to vet and manage strategic alliances is a step in the right direction. Kudos.

Interoperability matters. Compatibility across the stack is a must-have and stack players that didn’t learn the lessson of Betamax (in hopes of another iPod) may be deluding themsleves. Such a fast-buck approach has the technology seller helping themselves at their customers long-term expense…almost becoming parastic. Investors and entrepreneurs take note: the new stack won’t tolerate old stack micro-monopolies: plan on more Schumpeterian creative destruction.

In the end, it is all about risk-sharing: stack buyers that don’t perform adequate diligence, risk being marginalized by lock-in. At the same time, stack sellers that cannot constantly adapt to the marketplace will become riskier bets.

Just make sure you’re not stuck with them.

[UPDATE: AdExchanger had an intro which didn’t quite capture the point. Whether you buy a la carte or bundled technologies doesn’t matter. What matters is how those technologies integrate (or don’t) with each other and how easily you can test them. Tag management/data sharing technologies (especially pure-plays) can mitigate the inflexibility of tag based lock-in.]

MANUFACTURING VALUE. Certainly Andy Grove is a successful businessman with some very valid points about the back-end/residual value of manufacturing jobs to the broader US economy. Andy bemoans the fact that many Asian countries (and Mexico) have gained manufacturing jobs at the American economy’s collective expense. Most people would agree that this has had a generally negative effect on the US economy.

GAME THEORY. Outside of winning on philosophy, game theory tells suggests that China, India, Mexico and others beat us at our own game; the USA’s shrinking manufacturing economy and trade deficit suggests we lost a lot. It is a tricky situation because China and other countries rigged their economies to absorb more and more manufacturing business. At the same time, the US stuck to it’s libertarian free-market roots on the one-hand (pushing for free trade) but continued to tack-on more and more regulation of business (nanny-state).The bottom-line is that this was a terrible combination that resulted in fewer US manufacturing businesses, shrinking jobs with what was left over being even more costly (outside Silicon Valley, think Detroit auto-industry). Unfortunately, as many states (California, Illinois, Michigan, New York) are now finding, you can’t collect tax revenues to fund their bureaucracies off of business and people that left or went bankrupt. Consider that it took just that – bankruptcy for GM to renegotiate with their unions.

Does eschewing those capitalist American ideas by imposing new tariffs on imported goods and new taxes on offshore operations make sense? Probably not.

GET MANUFACTURING-FRIENDLY

Many American businesses would prefer to build operations here but simply can’t afford to when they are facing global competition. Think about it: there is a reason why the non-union auto industry developed away from the politics of the Michigan economy, e.g. BMW in North Carolina and Honda in Indiana, etc…Unfortunately, the current Obama administration is already going the wrong-way way with “health-care reform.” Only by reducing the colossal HR red-tape and onerous labor laws states or counties could compete for business and WIN.Maybe Andy will contribute from his Intel stock to help fund this!

🙂

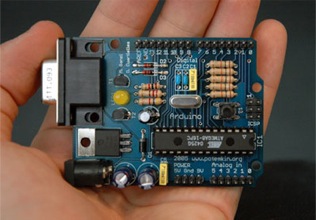

Here’s what happened: teenage daughter is building a project in class (2-for-1 re-purposed for another class mind you). Involved controlling LEDs in an array for a ornamental appliance…she had some ideas.

We visited Fry’s to see what they had as far as microcontrollers with basic documentation…kind of pricey for science experimentation. Then she mentioned that at her school, kids suggested Arduino to her. Saw it in a book on robot-making. After alot of research on Arduino’s site we picked up the Duemillenove model and a book by one of the main collaborators Massimo Banzi. We’ve both been reading this very good introductory book (published by O’Reilly). It spans, electronics, programming, crowdsourcing and hacking ethos in a very encouraging way.

Great article in Wired, Build It. Share It. Profit. talking about the team, concept of open hardware and fascinating implications for the manufacturing business models. Not clear if it will work(long-term), but definitely some food for thought as to how it is working(short-term). Interesting how many haters miss the point in the comments…

Bravissimo…stay tuned for updates on the forthcoming gadget.

Harvard Business School Associate Professor of Marketing, Anita Elberse (HBS – Bio) takes down Wired Editor-in-Chief, Chris Anderson (finally) on the latest online business fad: The Long Tail concept. This is basically, “make it up in volume” notion.

Harvard Business School Associate Professor of Marketing, Anita Elberse (HBS – Bio) takes down Wired Editor-in-Chief, Chris Anderson (finally) on the latest online business fad: The Long Tail concept. This is basically, “make it up in volume” notion.

While it may be true that distribution of certain goods is less expensive in an online setting (sometimes), human behavior is pretty solidly on hits, fads and top sellers. Sure, there will always be a small market for random Oldies and nostalgia but that business simply does not scale and is often referred to as “niche”. Here is Elberse’s work:

So what is the “The Long Tail” premise? Nothing original, just a “Business 2.0” rip of the Pareto Principle (aka 80-20 rule) developed by Economist Vilfredo Pareto over 100 years ago. When I worked for mass drugstore chain Walgreen’s and got to observe consumer behavior up-close-and-personal, common sense business contradicts the Long-Tail concept.

The longish defense from Chris Anderson in response to Elberse: