Facebook just announced the other day that it would acquire Atlas Solutions, a long-time competitor to Google’s DFA in the agency ad server business. As an adverlytics practitioner, many are asking about this and still more discussing the implications. Though the trade press will gush, investors may cheer and Atlas employees may be breathing a sigh of relief, it is truly a sad day for digital advertisers. Why? The choices available for independent third party ad serving (3PAS) just got much thinner.

The Rationale

To be sure this is a canny move for Baby Google, just as Google’s DoubleClick acquisition engorged the dataplex with rich user-level behavioral data that spanned both both buy-side (DFA) and sell-side (DFP) – it was brilliant. And after several years, the folks at Google decided to invest in the DFA reporting interface and we now have a Google Analytics like wrapper (except it is now green). Not much improvement on core functionality like reach and frequency reporting, but hey – it is better than ReportCentral.

The fact that DFA has maintained such a large market share since the Google acquisition suggests that client’s aren’t paying close attention to ad serving details. The very notion of pushback from advertisers and agencies is so unlikely that now, Google will also tell you how many of their ads were viewable, too. The Facebook deal is banking on it. For that matter, MediaPlex was absorbed into ValueClick way back in 2001 – they also own an ad network, an affiliate platform and Dotomi.

For Facebook, this is a very smart move although it relies on digital marketers being easily distracted and not looking too closely. In this deal, it is not really about “closing the loop” for advertisers. FB could ostensibly do this now with the much heralded unicorn called the Conversion Pixel or View-Tags. What they are “closing the loop” on is their understanding and ability to datamine what many other advertisers campaigns are doing, and the targets of those ad campaigns and those behaviors across client sites via the Atlas Universal Tracking Tag infrastructure. It probably won’t be long before Facebook offers their own Analytics platform or maybe a Tag Management System. Like its hero, FB is often times ethically challenged when it comes to who’s data is it any way. Just recently, it was revealed that Facebook has manipulated their advertisers’ campaign performance reporting.

That said, Atlas as a platform has faded over the years and needs investment to compete. It’s once advanced approach to attribution Engagement Mapping and stream of research from the Atlast Institute was a favorite among the analytics-minded. Yet, under Microsoft this pioneer of ad serving suffered from functional obsolescence as more site-centric and advanced algorithmic measurement has become more available. At the same time, Pointroll and MediaMind pivoted from rich media platforms to full-bodied ad servers. Many digital ad ops people that used Atlas regularly liked it, but later complained about lack of support. The upside is that Atlas won’t be shutting down anytime soon.

However, digital advertisers and agencies should be on notice now more than ever.

Recommendations

- Don’t Buy Technology and Media From the Same Vendor – In a world of digital marketing and an endless stream of bright shiny objects, it should give client-side marketers and savvy agencies pause that this is a serious conflict-of-interest that work against them. Since these ad serving tools are often counting ad impressions and clicks that they themselves sold – there is an incentive for self-serving manipulation.

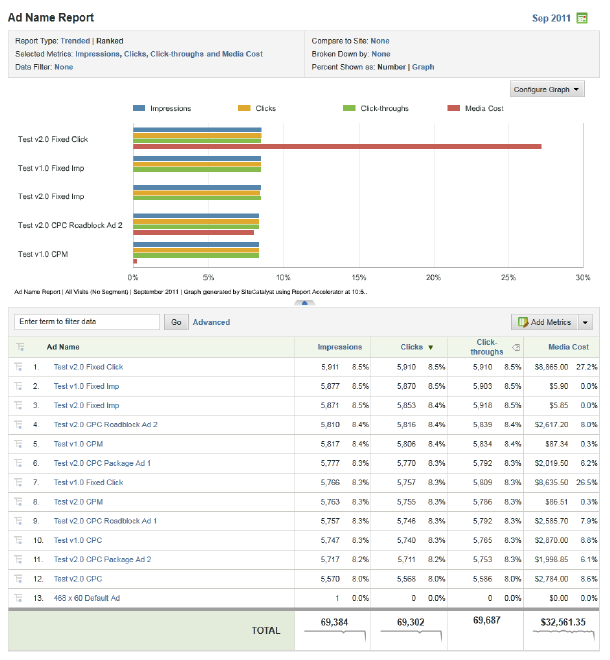

- For a better idea of how campaigns are performing leverage tools like Omniture, ComScore’s DigitalAnalytix. Coremetrics and WebTrends.

- For more advanced attribution measurement look at independent tools like Adometry, Visual IQ or C3.

- Don’t Share your Behavioral Data – For the pleasure of sharing your valuable behavioral data, you are probably paying $0.04 oto $0.08 CPM to Google (through your agency and this may be marked-up). In this respect, far too many digital media agencies are dropping the ball on data stewardship and going with what is expedient. Ultimately reflects on them, but it also speaks to rampant client-side advertiser ambivalence or worse ignorance.

- For those that insist are intentionally looking to harness their user data, at least get something in return for example by joining a data co-op like Akamai ADS (now part of MediaMath). Privacy policy implications may vary.

Advertisers and their agencies need to understand the very high proce they are paying. Time to look away from the Google, ValueClick and now the Facebook ad stack and consider other choices toute suite. In terms of ad servers left, the remaining major independent ad servers include MediaMind and Pointroll (though it is technically owned by Gannett, a newspaper company this is not as big a data play).

Final Thought: Where is the FTC?

Not sure where the FTC will come down on this but they essentially rubber-stamped the Google-DoubleClick acquisition back in 2007. Arguably this deal really does limit choice for digital advertisers but don’t count on the FTC doing much to scrutinize this. That digital advertisers and their agencies don’t value independent ad serving (and free of back-door data siphoning) is their problem and eventually it will sort itself out. To be sure the digital media ecosystem is complex and constantly-changing and federal bureacrtas are more focused on other more important matters. Plus, ad-serving just doesn’t make headlines like nefarious cookie tracking and consumer privacy.